CP Group, a vertically integrated commercial real estate and management firm, has been a leading owner-operator and developer of commercial real estate throughout the Sunbelt since 1986. Today, CP Group is the largest office landlord in Florida, Atlanta’s largest private commercial property owner, and in the top 25 of largest office landlords in the United States.

CP Group brings an extensive track record and unparalleled market insight to advance investors’ opportunities in the region’s most dynamic markets. Headquartered in Boca Raton, Florida, the company has a corporate office in Atlanta and regional offices in Dallas, Denver, Jacksonville, Miami, and Washington DC.

Gross Assets Acquired

Acquisitions

SF Owned/Managed

Gross Assets Acquired

Acquisitions

SF Owned/Managed

Experienced & Disciplined

Senior leadership has an average of 20 years’ experience working together.

Superior, local knowledge provides flexibility for vertical integration.

A balanced asset- and market-driven approach to maximize returns.

SUPERIOR PERFORMANCE

We acquire well-located, underperforming properties in markets characterized by long-term secular growth trends with proven institutional investor interest. We leverage our best-in-class local operating platform to identify these assets, “fix” them and then sell them to investors seeking high-quality, stabilized investments.

Since 2000, employing this strategy has allowed us to generate an average IRR of 20% and 2.2x equity multiple.

Years

Properties

Square Feet

Vision

2021

Crocker Partners rebrands as CP Group to represent a new era of the firm, encompassing the roles of each member of the organization and investing further in our target markets.

2020

Managing Partner Angelo Bianco and Partner Christopher Eachus buy out remaining principals to take dual ownership of the firm

2019

Crocker Partners invests nearly $200 million to expand their Atlanta portfolio to over three million square feet under management

2018

Crocker Partners acquires and recapitalizes nearly $1 billion of value-add real estate, bringing the portfolio to over 11 million SF and becoming the 39th largest office owner in the US

2017

Angelo Bianco appointed as Managing Partner of Crocker Partners, Tom Crocker takes on a senior advisory role

2014 - 2017

CP IV invests $807 million in nine value-add assets, becoming the largest office landlord in Florida

2011 - 2013

Taking advantage of distressed market conditions, CP IV deploys over $918 million of equity in 11 assets located in its target markets, totaling 5 million SF

2008 - 2010

Preserving capital through the Great Recession, CP IV invests only $1.7 million and focuses on optimizing cash flow through best-in-class asset management

2007

Crocker Partners IV (CP IV), a $212 million discretionary, co-mingled fund among institutional investment partners is launched

2005

CRT III is sold for $1.8 billion, generating a Net IRR of 20.7% and a Multiple of 2.8x. Combined, Crocker’s three previous investment vehicles average an IRR of 29.1%

2000 - 2005

CRT III invests $722 million of capital in 11 office acquisitions totaling 4.8 million SF in Florida, Georgia, Texas and Maryland

2000

CRT II makes a significant investment into Koger Equity, a 26 million SF NYSE REIT, to take over management and rebrands the company to CRT Properties, Inc. (CRT III)

1996 - 2003

A joint venture with Apollo is created to form Crocker Realty Trust, Inc. (CRT II) and subsequently invests over $450 million of capital in 43 office assets totaling 6.2 million SF across the Southeast

1996

CRT I portfolio is sold $562 million, generating a Net IRR of 45.2% and a Multiple of 1.5x

1993

Crocker Realty Trust, Inc. (CRT I), the first publicly-traded, blind pool REIT in the U.S., is founded

1986

Crocker & Company is founded to develop high-end mixed-use properties in Palm Beach County, including Mizner Park and Office Depot headquarters

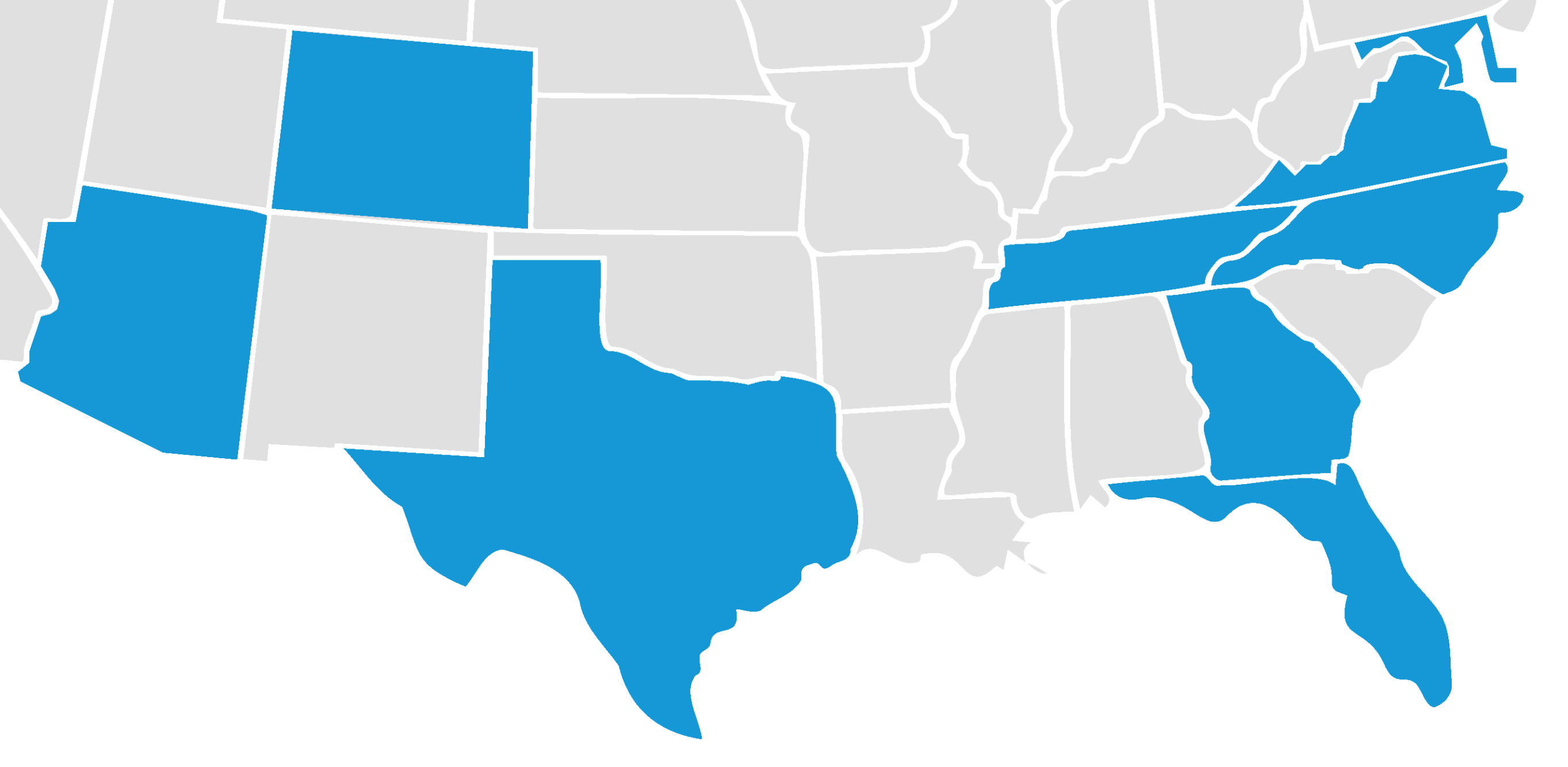

CP Group Target Markets

Led by Angelo Bianco and Chris Eachus, CP Group leverages its extensive experience and relationships in its Target Markets, which consist of high-growth metropolitan markets located in the “Smile States”.

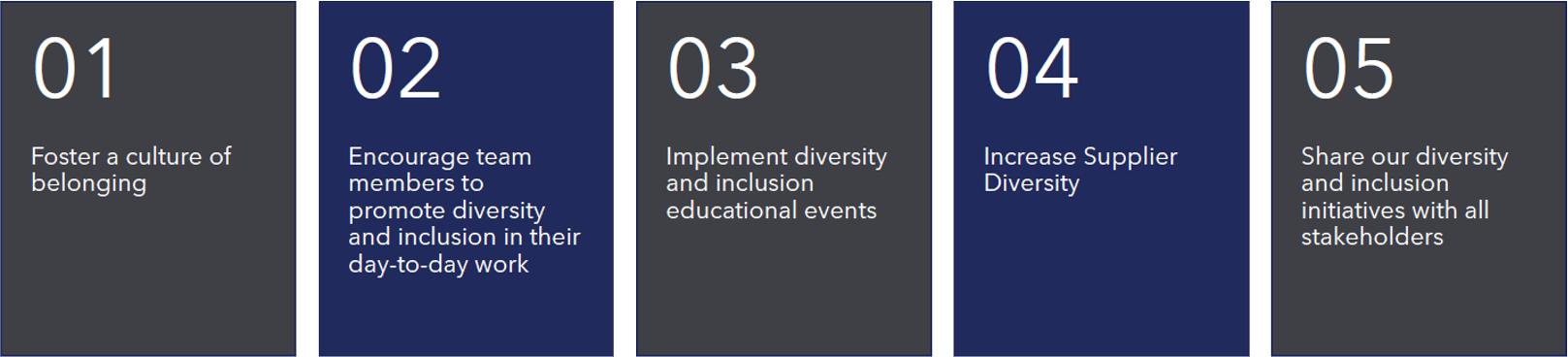

Diversity and Inclusion at CP Group

Diversity is our heritage. Inclusivity is our commitment.

- We are committed to being an organization where all employees feel they belong and bring their authentic selves to work each day.

- We value a diverse and inclusive workforce and aim to serve a diverse customer base.

- We celebrate diversity and inclusion in the workplace and listen and engage with our communities.

- We strive to foster an environment where CP Group employees, investment partners, tenants, and suppliers feel comfortable expressing different ideas, opinions, and

worldviews. - We believe that all individuals should receive the highest level of respect without regard to race, color, religion, national origin, gender, sexual orientation, age, or

disability. - We stand in solidarity against racism and advocate for diversity, equity, and inclusion in all CP Group activities and communities.

- We commit to establishing a Diversity and Inclusion strategy to increase the diversity of ideas, employee training, and opportunities that ensure all employees and

customers feel that they belong.